Michael Hudson’s simple phrase “Debts that can’t be repaid, won’t be repaid” sums up the economic dilemma of our times. This does not involve sanctioning “moral hazard”, since the real moral hazard was in the behavior of the finance sector in creating this debt in the first place. Most of this debt should never have been created. All it did was fund disguised Ponzi schemes that inflated asset values without adding to society’s productivity. The irresponsibility—and Moral Hazard—clearly lay with the lenders rather than the borrowers.

The question we face is not whether to repay this debt, but how to go about not repaying it?

The standard means of reducing debt—personal and corporate bankruptcies for some, slow repayment of debt in depressed economic conditions for others—could have us mired in deleveraging for one and a half decades, given its current rate. That would be one and a half decades where the boost to demand that rising debt should provide—as it finances investment rather than speculation—is absent. Growth is too slow to absorb new entrants into the workforce, innovation is muted, and political unrest rises–with all the social consequences. Just as it did in the Great Depression.

So it is incumbent for society to reduce the debt burden sooner rather than later, so as to reduce the period spent in the damaging process of deleveraging. Pre-Capitalist societies instituted the practice of the Jubilee to escape from similar traps, and debt defaults have been a common experience in the history of Capitalism too. So a prima facie alternative to 15 years of deleveraging is an old-fashioned debt Jubilee.

But a Jubilee in modern Capitalism faces two dilemmas. Firstly, a debt Jubilee would paralyse the financial sector by destroying bank assets. Secondly, in our era of securitized finance, the ownership of debt permeates society in the form of asset based securities (ABS) that generate income streams on which a multitude of non-bank recipients depend. Debt abolition would inevitably destroy both the assets and the income streams of owners of ABSs, most of whom are innocent bystanders to the delusion and fraud that gave us the subprime xrisis, and the myriad fiascos that Wall Street has perpetrated in the 25 years since the 1987 stock market Crash.

We therefore need a way to short-circuit the process of debt-deleveraging, while not destroying the assets of both the banking sector and the members of the non-banking public who purchased ABSs. One feasible means to do this is a “Modern Jubilee”, which could also be described as “Quantitative Easing for the public”.

Quantitative Easing was undertaken in the false belief that this would “kick start” the economy by spurring bank lending. Barack Obama put it:

And although there are a lot of Americans who understandably think that government money would be better spent going directly to families and businesses instead of banks – “Where is our bailout?,” they ask – the truth is that a dollar of capital in a bank can actually result in eight or ten dollars of loans to families and businesses, a multiplier effect that can ultimately lead to a faster pace of economic growth. (Obama 2009)

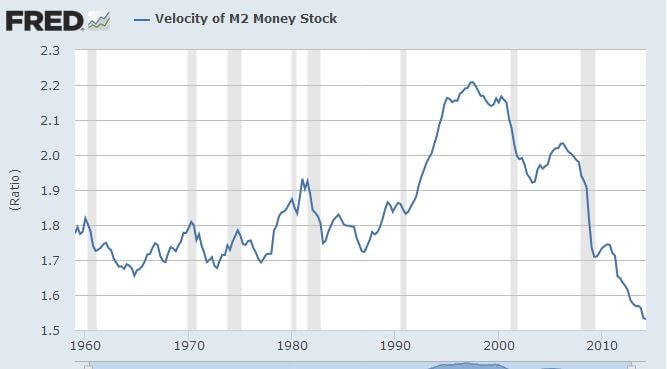

Instead, QE’s main effect was to dramatically increase the idle reserves of the banking sector while the broad money supply stagnated or fell (see figure). There is already too much private sector debt, and neither lenders nor the public want to take on more debt.

A Modern Jubilee would create fiat money in the same way as QE, but would direct that money to the bank accounts of the public with the requirement that the first use of this money would be to reduce debt. Debtors whose debt exceeded their injection would have their debt reduced but not eliminated, while at the other extreme, recipients with no debt would receive a cash injection into their deposit accounts.

The broad effects of a Modern Jubilee would be:

- Debtors would have their debt level reduced;

- Non-debtors would receive a cash injection;

- The value of bank assets would remain constant, but the distribution would alter with debt-instruments declining in value and cash assets rising;

- Bank income would fall, since debt is an income-earning asset for a bank while cash reserves are not;

- The income flows to asset-backed securities would fall, since a substantial proportion of the debt backing such securities would be paid off; and

- Members of the public (both individuals and corporations) who owned asset-backed-securities would have increased cash holdings out of which they could spend in lieu of the income stream from ABS’s on which they were previously dependent.

Clearly there are numerous and complex issues to be considered in such a policy:

- The scale of money creation needed to have a significant positive impact (without excessive negative effects. [There will obviously be such effects, but their importance should be judged against the alternative of continued deleveraging.]

- The mechanics of the money creation process itself (which could replicate those of Quantitative Easing, but may also require changes to regulation prohibitiing Reserve Banks from buying government bonds directly from the Treasury).

- The basis on which the funds would be distributed to the public;

- Managing bank liquidity problems (since though banks would not be made insolvent by such a policy, they would suffer significant drops in their income streams);

- Ensuring that the program did not simply start another asset bubble.

More to read:

Steve Keen’s Dynamic Model of the Economy

Key Benefits of Hiring Experienced Commercial Lawyers in Sydney